The ongoing Covid-19 pandemic has led to changing behaviours with people working, shopping and communicating more online.

How has this shift impacted fraud activity? And what can you do to protect yourself from the most prevalent crime encountered in the UK?

What is fraud?

Fraud is when a person deliberately deceives a victim to gain an advantage. This can be taking someone's money or learning private information about them. Fraud can happen via email, text, phone or in person.

Fraud can be committed against individuals or businesses.

What impact has the pandemic had?

The Covid-19 pandemic has created a new normal for billions of people around the world. More people are working from home, and shopping and socialising online. With this come criminals taking advantage of it.

An Action Fraud spokesperson said: "We have sadly seen devious criminals taking advantage of the coronavirus pandemic as a means to commit fraud."

"To carry out their scams, criminals have been honing in on people's anxieties and the changes that have occurred to our daily lives.

"They have also been imitating well-known and trusted organisations, such as the NHS, Government, banks, parcel delivery companies and even broadband providers, to carry out sophisticated phishing and smishing scams over email and text message."

Figures from Action Fraud depict this increased fraud activity.

Action Fraud is the national fraud reporting centre that records incidents of fraud directly from the public and organisations.

Since the beginning of the pandemic, offences reported to Action Fraud have increased by a third.

In total, 445,267 fraud offences have been reported to Action Fraud between April 2020 and March 2021. They amount to a loss of £2.4 billion.

March 2021 saw the highest number of reported incidents. That month, 48,546 offences have been reported to Action Fraud. Almost twice as many as in March 2020.

What were the most common fraud types during the pandemic?

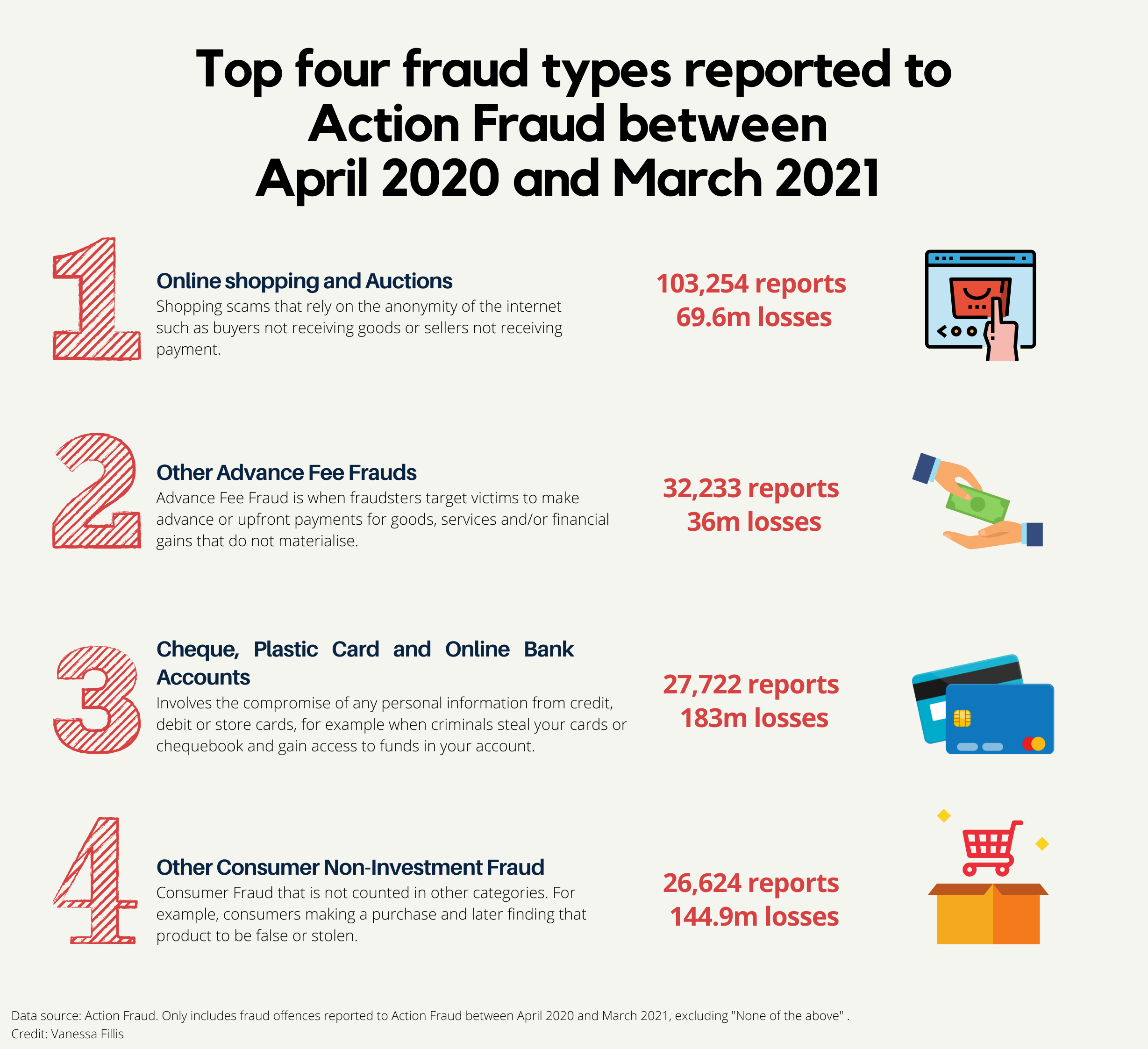

There are different types of fraud. Between April 2020 and March 2021, the most common fraud was relating to online shopping and auctions with over 100,000 reports made to Action Fraud. This is almost a quarter (23%) of all reports made to Action Fraud in that period.

Fraud relating to cheque, plastic card and online bank accounts accounted for the highest losses, although the number of reports was comparatively lower. In total, victims have lost £183 million to this kind of fraud between April 2020 and March 2021.

Data source: Action Fraud. Infographic credit: Vanessa Fillis

What happens after fraud is reported to Action Fraud?

Since Action Fraud does not have investigative powers, it sends its reports to the National Fraud Intelligence Bureau (NFIB).

The NFIB and Action Fraud are both run by the City of London Police, the national lead force for fraud.

Besides reports from Action Fraud, NFIB receives reports from the two industry bodies Cifas and UK Finance. They report instances of fraud where their member organisations have been a victim.

NFIB experts assess and analyse reports that are sent to them. They look out for information that could be used by police forces to progress an investigation.

Not all reports are sent to police forces or law enforcement agencies for investigation. Some are sent to the Prevention and Disruption Team which will take steps to prevent others from becoming victims. For example, they can block phone numbers or websites.

Analysing the reports enables the NFIB to provide timely information and advice that helps to protect the public. Although not all reports result in an investigation, they contribute to building a clear picture about fraud in the UK.

Does every victim report fraud?

The majority of fraud goes unreported, figures by the Office for National Statistics (ONS) suggest.

Based on their latest (telephone-operated) Crime Survey for England and Wales, they estimate that there were 4.4 million fraud offences between October 2019 and September 2020.

In the same period, 759,854 fraud offences have been reported to the National Fraud Intelligence Bureau (via Action Fraud, UK Finance and Cifas). This suggests that only 17 per cent of fraud offences have been reported.

Richard Hall, Senior Associate in the Data Protection and Cyber Security team at law firm DWF, is not surprised by the low levels of reports being made:

"With the victim blame culture that exists with these offences, as well as the general public perception that there is limited action that the relevant authorities can or will take against the offending criminals, it is perhaps not surprising to see such low numbers of reports being made."

He says that the underreporting of fraud offences hinders the prosecution and prevention of fraud.

"If the relevant authorities are not even being told about these offences when they arise, they stand no chance of making real progress against the growing criminal activities in the cyberspace and many criminals will go unpunished."

Furthermore, the low level of criminal complaints being made makes these offences an attractive proposition for criminals and creates "greater risks for individuals and businesses alike".

Therefore he urges victims to report fraud:

"We all need to take some responsibility and can all start to help through the most basic of actions, of reporting these offences when they arise."

How can you protect yourself from fraud?

Compared to other crimes, fraud has the highest prevalence in the UK. It has an incidence rate of 96 per 100,000 people. It is followed by criminal damage which has a rate of 42 per 100,000 people.

Therefore, an Action Fraud spokesperson reminds the public to remain vigilant and to take a moment to think before parting with their money or information.

"If you receive a text, email or phone call that you weren't expecting, asking for your personal or financial details, don't be afraid to challenge it. Could it be fake? Only criminals will try to rush and panic you."

Additionally, the national Take Five to Stop Fraud campaign, run by UK Finance, offers advice to help people spot scams and protect themselves against fraud.

If you receive a call or text asking you to act urgently #TakeFive✋

— Take Five (@TakeFive) March 31, 2021

Remember to:

Stop: Think before parting with your money or information

Challenge: Could it be fake?

Protect: If you think you’ve fallen for a scam contact your bank immediately pic.twitter.com/0kQnDGwUaz

What do you need to consider now that restrictions are easing?

With lockdown restrictions easing and people booking holidays and concert tickets, UK Finance warns against fraudsters targeting the British public with ticketing, travel and health insurance scams.

This can be criminals advertising holidays and tickets at low prices or for sold out events. Their strategies are impersonating trusted organisations such as travel agencies and hospitality firms and using a range of sophisticated methods to approach their victims, including scam emails, telephone calls, fake websites and posts on social media.

Katy Worobec, Managing Director of Economic Crime at UK Finance, warns that the easing of lockdown restrictions provides another opportunity for fraudsters to target victims.

"As you start booking holidays and planning social activities, don't let criminals take you for a ride. Follow the advice of the Take Five to Stop Fraud campaign and always visit websites you're buying from by typing it into the web browser - avoid clicking on links in unsolicited emails or text messages."Be wary of any requests to pay by bank transfer when buying or booking services online, and instead use a credit card or the secure payment options recommended by reputable websites."

What should you do if you have been a victim of fraud?

If you think you have been the victim of a fraud, contact your bank immediately and report what has happened to Action Fraud via their website or by calling 0300 123 2040.

You can report suspicious emails you have received but not acted upon by forwarding the original message to report@phishing.gov.uk. You can report suspicious texts you have received but not acted upon by forwarding the original message to 7726.

Resources

- Action Fraud informs the public about the latest scams and how people can protect themselves.

- The Take Five to Stop Fraud campaign offers guidance on how consumers can protect themselves in the lead-up to further easing of lockdown restrictions.

- You can Take Five to Stop Fraud campaign's quiz to test if you are scam savvy.

- Victim Support gives free and confidential help to victims of fraud.